Introduction: The Double-Edged Nature of Financial Advertising

In 2025, the global digital advertising landscape continues to expand. According to Statista's Global Advertising Expenditure Report, total ad spending is projected to surpass $1.2 trillion, with financial services ranking among the fastest-growing verticals.

However, this growth comes with heightened scrutiny. Financial advertising, covering investment, forex, crypto, and lending, is now one of the most tightly regulated categories across major platforms such as Google, Meta, and emerging networks like Kwai, Bigo Ads, MediaGo, and Moloco.

This creates a paradox: high ROI potential but also high compliance risk.

How can financial advertisers scale safely while staying compliant with ever-changing regulations?

As a global ad account provider, Novabeyond has helped financial and investment brands build compliant advertising infrastructures, achieve higher ROI, and reduce account suspension risks. This article explores the full scope of compliance, risk management, and strategy in financial advertising.

Overview of Key Regulatory Policies on Top Advertising Platforms

2.1 Google Ads: Financial Services Certification Is Now Mandatory

Google Ads enforces strict rules for financial advertisers. Since 2022, any campaigns related to loans, investments, crypto, or financial advice must obtain Google's Financial Services Certification.

● Valid licensing from recognized financial authorities.

● Accurate, non-misleading ad copy that matches the landing page.

● Transparent business disclosure (company registration, address, etc.).

Google's 2025 policy updates introduce “advertiser identity tracking”, meaning even linked accounts or shared landing pages can trigger platform-wide bans if they are flagged as high-risk.

2.2 Meta (Facebook / Instagram): Transparency and Authenticity First

Meta's ad policies emphasize identity transparency and truthful communication:

● Every financial ad must display the company's legal name, business registration, and address.

● Mandatory risk disclosures for investment and lending content.

● Ads must not promise guaranteed or exaggerated returns.

Meta's AI-driven semantic detection system automatically identifies misleading claims like “earn triple income in 30 days” or “zero-risk profit” and blocks them preemptively.

2.3 Emerging Platforms: Kwai, BIGO Ads, MediaGo, and Moloco

Emerging platforms, particularly in Southeast Asia and Latin America, are tightening financial ad requirements.

● Kwai Ads now requires financial license registration numbers in targeted markets.

● BIGO Ads limits high-frequency ad permissions to certified “whitelisted” accounts.

● MediaGo and Moloco are adopting trust scoring systems to evaluate advertiser credibility.

Understanding Risks and Building a Robust Control System

3.1 Account Suspension and Ad Disruption

● Cross-region account usage;

● Unverified or mismatched payment methods;

● Discrepancies between ad content and landing page claims.

● Implement a multi-account architecture (test → production → scaling);

● Use agency accounts with verified payment profiles;

● Regularly audit ad creatives and landing pages for policy alignment.

Before onboarding clients, Novabeyond conducts a “pre-risk audit” evaluating creatives, landing pages, and account compliance level significantly reducing suspension probability.

3.2 Ad Creative and Landing Page Consistency

Best practices include:

● Focus on educational content (e.g., “investment learning,” “AI trading insights”).

● Avoid misleading metrics or aggressive calls-to-action.

● Ensure landing pages include legal disclaimers, contact details, and privacy policy links.

3.3 Data Privacy and Security Compliance

With GDPR and CCPA in full force, financial advertisers must collect and store user data transparently.

● Use native tracking tools (eg: Google Tag Manager, Meta Pixel) instead of unverified third-party scripts.

● Provide an opt-out option on every page.

● Clearly state data collection purposes and risk disclosures.

Strategic Framework for Financial Advertising

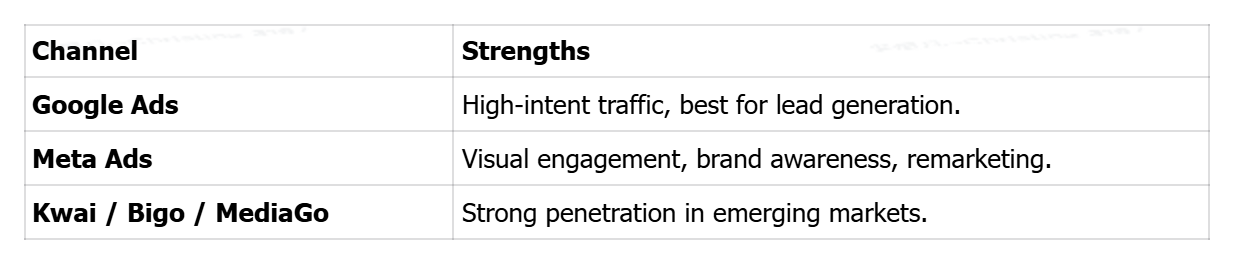

4.1 Multi Channel Media Mix

Relying on a single platform increases risk. A diversified channel mix provides both reach and stability.

According to DataReportal 2025 Global Overview, Kwai's monthly active users in Southeast Asia have grown over 40%, creating a fresh opportunity for fintech brands seeking user acquisition in mobile-first markets.

4.2 Account Structuring & Budget Control

1. Testing Layer:Identify performing creatives & audiences.

2. Core Layer:Consolidate top performing ad sets.

3. Scaling Layer:Gradually expand budgets across verified accounts.

Use automated bidding strategies (eg:Maximize Conversions on Google or CBO on Meta) for efficiency and consistent ROI.

4.3 Creative Optimization and Trust Building

● Educational short videos explaining financial concepts.

● Displaying regulatory license numbers and client testimonials.

● Transparent communication avoid unrealistic claims.

Chart Placeholder: CTR comparison educational vs profit driven ad creatives.

Novabeyond Financial Advertising Account & Compliance Solutions

Novabeyond is a global ad account provider specializing in compliant ad setup and campaign management for brands worldwide, including those in highly regulated sectors such as financial services.

Our core offerings include:

● Multi-platform Ad Account Access:Google, Meta, Bigo, Kwai, MediaGo, Moloco, and Mintegral.

● Pre-launch Compliance Audit:ad creatives, domains, and financial disclosure validation.

● Performance Optimization:campaign structure, bidding, and analytics.

● Global Payment & Billing:secure multi currency billing management.

● Dedicated Account Managers:one-on-one support for enterprise clients.

Conclusion: Compliance as the Foundation of Growth

The era of aggressive financial advertising is over. Today, compliance, transparency, and user trust define success.

Advertisers who build compliance-first strategies will not only protect their accounts but also unlock long-term brand credibility and sustainable ROI.

Recommended reading

How can financial brands advertise without getting banned on Google or Meta?

Financial ads are under the heaviest scrutiny ever.

2025 Financial Advertising Compliance & Risk Strategy Explained

Mintegral Ad Cost Explained: Pricing, Budget Planning, and Scaling Strategy Guide

March. 02 2026

LEARN MORE

2026 Mintegral Ad Cost: Pricing & Scalability Insights

February. 25 2026

LEARN MORE

Google Ads Tutorial 2026: Step-by-Step Guide

February. 09 2026

LEARN MORE

2026 Why BIGO Ads Account Rejected? (How to Fix)

February. 04 2026

LEARN MORE