Introduction

As global mobile gaming revenue surpasses $200 billion (Data.ai), user acquisition remains the core driver for game publishers expanding overseas. With BIGO Ads, Kwai for Business, and Moloco emerging as high-growth ad channels, understanding how to open accounts, run test campaigns, optimize traffic, and improve ROI has become essential.

This article provides a comprehensive comparison of the three platforms—including user demographics, ad features, regional performance, creative strategy, optimization techniques, and platform-specific data benchmarks, designed to help mobile game advertisers build a high-performance global buying strategy.

Global Mobile Gaming Expansion Trends (2025 Data Overview)

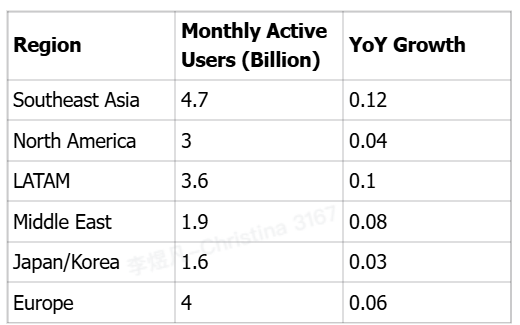

1. Global mobile gamer distribution

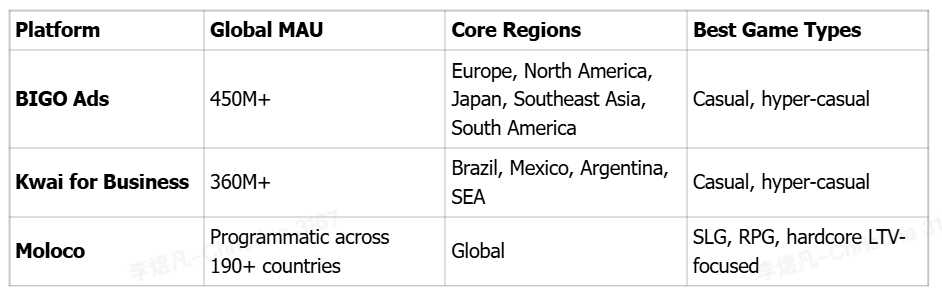

2. BIGO Ads / Kwai / Moloco global coverage

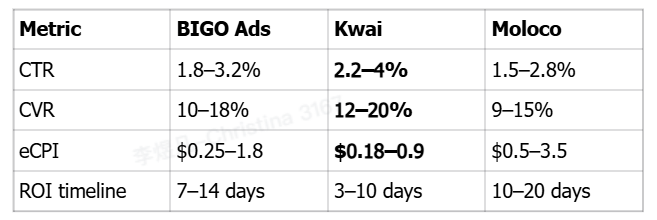

3. Mobile game ad performance benchmarks

These numbers will serve as reference points as we dive into each platform’s strengths and strategic approach.

BIGO Ads Strategy Guide (Europe / North America / Japan / SEA / South America)

BIGO Ads leverages traffic from apps Likee and imo, reaching over 450 million monthly active users. It is ideal for scaling across multiple regions while keeping CPI stable.

1. User demographics

● Core regions: Europe, North America, Japan, Southeast Asia, South America

● Age 18–34: 72%

● Strong interest in gaming, short video, livestreams

● High LTV regions: US, Canada, Germany, Japan

● Low CPI regions: Indonesia, Brazil, Philippines

2. Ad formats

3. BIGO Ads campaign strategy

(1) Creative strategy

● Best performing length: 6–12 seconds

● Show the core gameplay within first 1–2 seconds

● Prepare at least 12–20 creatives for the initial learning phase

(2) Regional structure

● Tier 1 (US/EU/JP): separate ad sets, stable budget

● Tier 2 (SEA/SAM): cluster campaigns for rapid volume

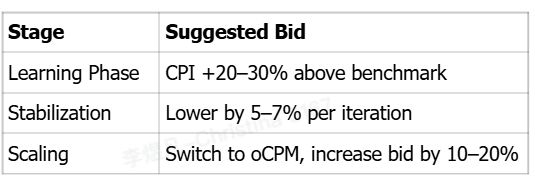

(3) Bidding strategy

3.1 Optimization formula

● Lower eCPI: refresh creatives and adjust interest tags

● Improve CVR: clearer UI shots, reward prompt

● Boost ROI: prioritize high-value regions like US, JP, DE

Kwai for Business (Kwai / Kuaishou International)

1. User demographics

● LATAM: 70%+

● Global MAU: 360 million

● Ages 18–30: 67%

● High engagement, high ad click-through culture

2. Ad performance

● CTR: 2.2–4%

● CVR: 12–20%

● eCPI: $0.18–0.9

These numbers make Kwai one of the lowest-cost channels for gaming advertisers.

3. Kwai campaign strategy

(1) Low-CPI scaling for casual games

● Casual

● Simulation

● Hyper-casual

● Puzzle games

(2) “Local emotional content” works best

LATAM users prefer:

● Exaggerated expressions

● Dramatic failure to success transitions

● Fast gameplay demonstrations

● Strong visual contrast

CTR can increase 20%+ with these elements.

(3) Improving retention

Kwai’s low-quality traffic risk can be managed by:

● Enhanced onboarding flow

● Early reward incentives

● Pushing players into the core loop

Retention can rise from 18% to 25–28% with optimization.

Moloco (Programmatic DSP) Strategy

● High LTV games (RPG, SLG, MMO)

● Markets like US, JP, KR, EU

● Long-term ROAS optimization

Key advantages

● Covers 190+ countries

● Machine learning improves with spending

● ROAS generally stabilizes within 10–20 days

Campaign strategy

(1) Use AEO/ROAS optimization

(2) High-quality event reporting

Recommended:

● Registration

● Tutorial complete

● Day-1 retention

● Purchase events (with granular values)

Accurate events can increase ROAS 15–30%.

(3) Wide audience targeting

Three-Platform Comparison (Quick View)

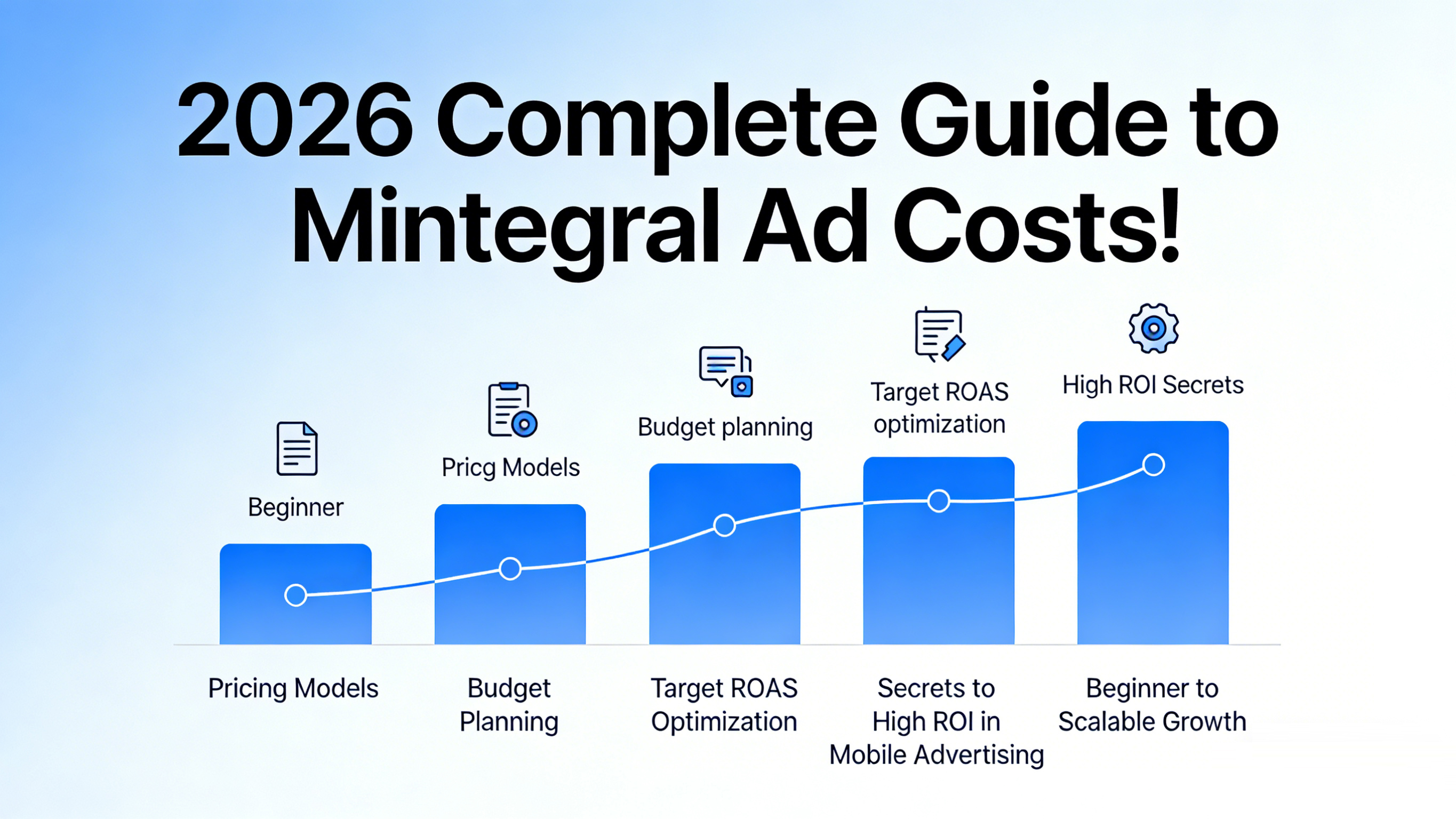

Daily Optimization Checklist

How to open BIGO Ads, Kwai, and Moloco ad accounts

Official BIGO Ads / Kwai / Moloco account opening

● Fast approval

● Exclusive support

● Strategy guidance for gaming advertisers

● Free account audit and creative plan

Recommended reading

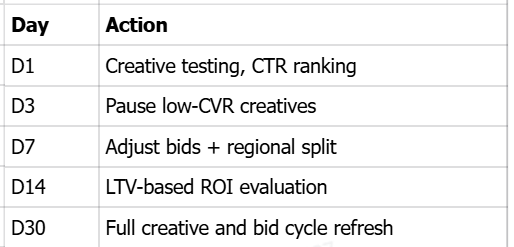

Mintegral Ad Cost Explained: Pricing, Budget Planning, and Scaling Strategy Guide

March. 02 2026

LEARN MORE

2026 Mintegral Ad Cost: Pricing & Scalability Insights

February. 25 2026

LEARN MORE

Google Ads Tutorial 2026: Step-by-Step Guide

February. 09 2026

LEARN MORE

2026 Why BIGO Ads Account Rejected? (How to Fix)

February. 04 2026

LEARN MORE