It’s understandable. Native ads blend seamlessly into content, lower user resistance, and have historically delivered strong ROI. For years, they were the fastest way to move performance metrics in the right direction.

But as more advertisers crowd into the same feed environments, native inventory has become increasingly competitive. CPMs are climbing, scaling is getting harder to sustain, and cold-start phases stretch longer with every new campaign. What once felt efficient now feels fragile.

If you want to break through the current growth ceiling, you have to break the mindset of "Native Only."

Today, combining MediaGo’s underlying algorithmic logic with our frontline experience, we break down how to build a more robust growth model using a Display + Native approach.

1. Why the “Native Only” Approach is Failing

In our account diagnostics, we often see a specific curve: native ads ramp up volume quickly at low budgets, but the moment you increase the budget, CPA spikes. Why? The "Fish Pond" Theory.

Native ads are great for generating interest, but their inventory is finite , mostly limited to content feeds. It’s like fishing in a small, high-quality pond; eventually, you run out of fish. No matter how strong your messaging is, the audience pool is finite.

Think of it this way:

● Native ads create depth of understanding

● Display ads create breadth of exposure

2. One Framework, Two Execution Paths

In practice, we apply two distinct MediaGo playbooks.

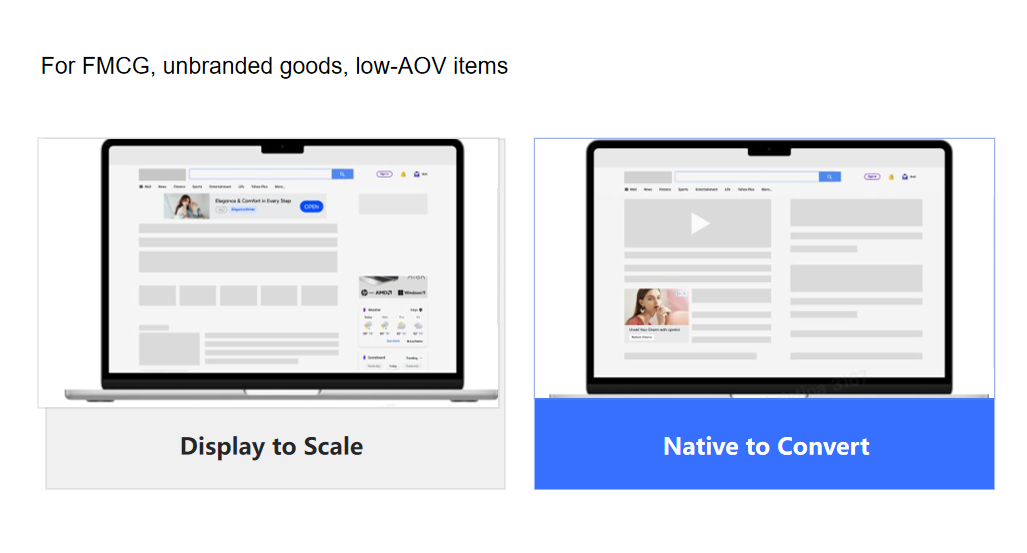

Path One: Display to Scale, Native to Convert

Best for FMCG, unbranded goods, low-AOV items

For categories like 3C accessories or daily necessities, where decisions are quick, the bottleneck is usually volume, not trust.

Phase 1: Scale with Display Ads

Phase 2: Close with Native Ads

Once users recognize the product, retarget their content feeds with native ads focusing on usage scenarios, social proof, and reassurance to remove final friction and trigger the sale.

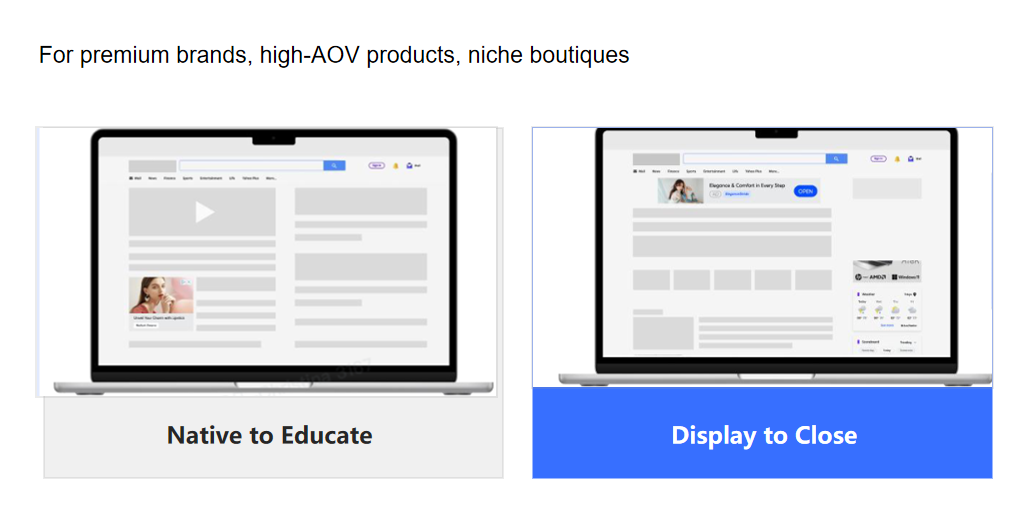

Path Two: Native to Educate, Display to Close

Best for premium brands, high-AOV products, niche boutiques

Phase 1: Native for Telling a Story

Use native ads for telling stories, comparisons, reviews, and brand narratives to build trust. Don’t obsess over immediate ROI here; look at "Add to Cart" rates and "Time on Site." Success at this stage is measured by engagement.

When a user is interested but hasn’t bought yet, display ads become the reminder. We use MediaGo’s algorithm to follow these users across the web with branded banners that reinforce the core selling point until the conversion happens.

3 . Execution: How to Run This Like a Pro

Understanding the framework is only half the battle. Execution determines outcomes. Based on MediaGo’s SmartBid 3.0 capabilities, here are two keys to success.

3.1 Maintain Visual Consistency

A common mistake is having one for display and another for native ads separately, resulting in a disconnected look.

Visual continuity triggers memory recall and builds brand accumulation. Consistent colors, messaging, and visual cues ensure that users instantly recognize the brand, even when encountering it across different placements and formats.

3.2 Use Bidding Models Strategically, Not Rigidly

Cold Start Phase: Use Max CV mode with display ads to accelerate audience discovery and shorten the learning period.

MediaGo’s strength isn’t just its access to premium global inventory. Its real advantage lies in how flexibly that traffic can be orchestrated. A Display + Native strategy isn’t about stacking two ad formats. It’s about aligning with human psychology and browsing behavior.

If you’re struggling with high costs and low scale on single-format campaigns, try this combination strategy. It may be time to stop “walking on one leg” and start growing with a more balanced, full-funnel approach.

NewsBreak Platform Overview: America’s Local News Feed Gateway

January. 14 2026

LEARN MORE

Snapchat: A Camera-First Platform Powering Authentic Digital Connection

January. 14 2026

LEARN MORE

50 Essential TikTok Statistics Every Marketer Must Know (2026 Edition)

January. 12 2026

LEARN MORE

BIGO Ads Q4 2025 Performance Recap

December. 18 2025

LEARN MORE